tax preparation fees 2020 california

Ad Find Recommended California Tax Accountants Fast Free on Bark. Financial planning billed at a.

California Use Tax Information

After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid.

. Tuition and fees deduction. Tax and Fee Rates The California Department of Tax and Fee Administration is responsible for the administration of over 30 different taxes and fees. Preparation fees are based on major schedules and forms used to complete the tax return electronic filing included.

Individual Nonresident Income Tax Return. But this tax fee wizard will help you skip the guesswork. Ad Honest Fast Help - A BBB Rated.

Ad Hiring Qualified and Vetted Talent Has Never Been Easier. Resolve Your IRS Issues Now. We specialize in tax preparation for small business LLCs rental properties foreign earned income exclusions capital gains asset dispositions etc.

Schedule A Itemized. Hire Top Talent Today. Typical fee range is 600 to.

Just answer three quick questions and youll find out what your peers are charging for their tax services. Offer valid for tax preparation fees for new clients only. HR Block has been approved by the.

Ad Find the Right Tax Relief Plan that Suits Your Needs Budget. Start wNo Money Down 100 Back Guarantee. Click Find Anthem Rate Review.

Upwork Makes It All Possible. 2020-2021 Income and Fees of Accountants and Tax Preparers in Public Practice. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in.

Thatll help you make better. Heres a look at the standard deduction for the 2019 and 2020 tax years. Are Investment Fees Deductible In California 2020.

Enter the larger of line 1 or line 2 here 3. The cost to prepare your tax return all comes down to the overall amount of time spent working on your returns. Form 1040X Amended Tax Return Originally Prepared by Taxlana Inc 20000.

Student loan interest deduction. Enter amount shown for your filing status. Form 1040NR US.

NSA conducts a periodic survey of members to gauge the average cost of preparing many types of tax. Federal 1040 and California 540 individual tax preparation starts. Post a Job Free and Get Qualified Proposals Within 24 Hours.

Ad Honest Fast Help - A BBB Rated. In this report weve broken down national and state averages for both individual and business tax returns so you can see. We Have Compared the Top 10 Tax Relief Companies.

Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams. Single or marriedRDP filing separately enter 4803 MarriedRDP filing jointly head of. From the original due date of your tax return.

To find the correct tax or. For schedules not listed please click here for fees. Start wNo Money Down 100 Back Guarantee.

Ad Learn What EYs Tax Reporting and Tax Operations Services Can Do for Your Business.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Pin By Tax Attorney Expert On Law Audit Services Tax Attorney Tax

What Is Casdi Employer Guide To California State Disability Insurance Gusto

What Are Marriage Penalties And Bonuses Tax Policy Center

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022

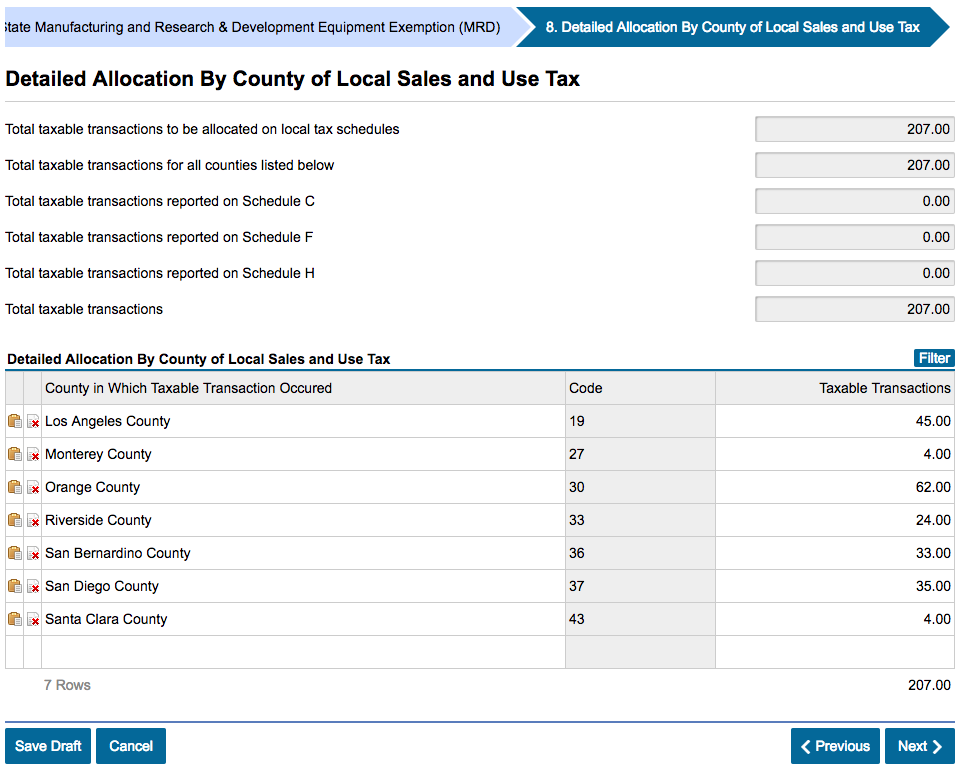

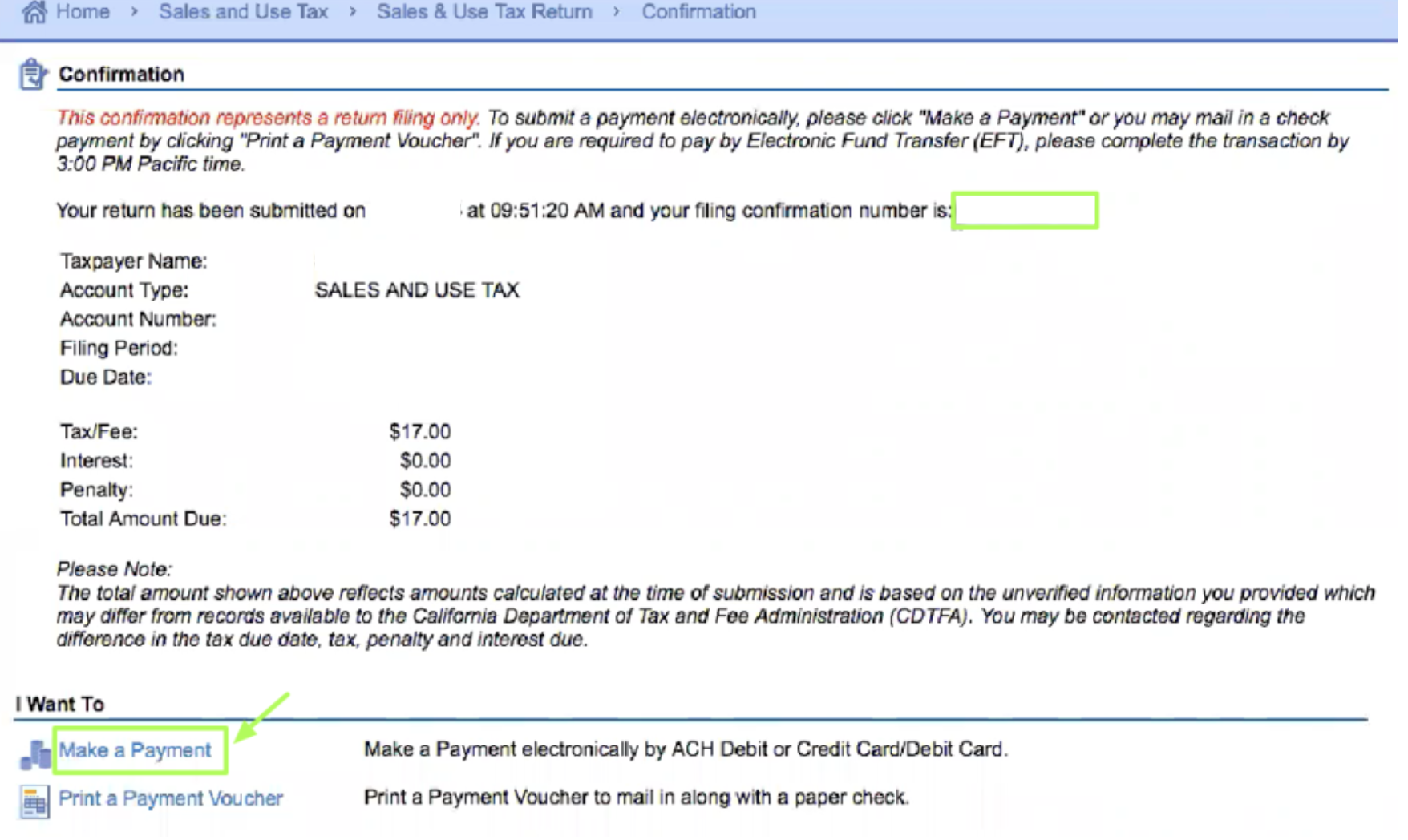

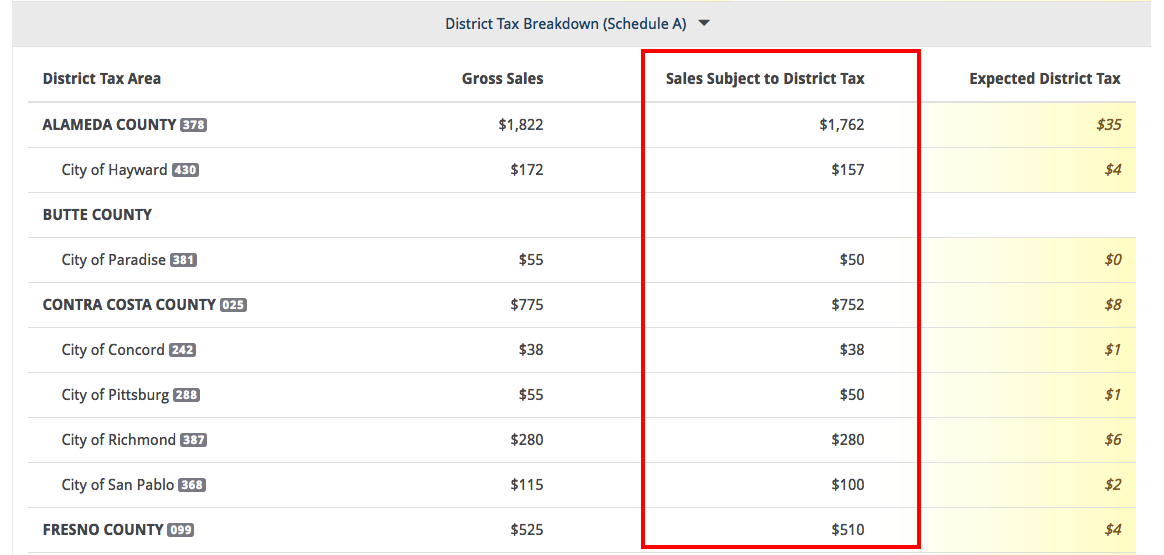

How To File A California Sales Tax Return Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Still Life Photography Workshop And Retreat Life Exposed Still Life Photography Life Photography Photography Workshops

New 2020 Ctec Requirements Start July 1 Federal Income Tax Income Tax Return Tax Preparation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To File A California Sales Tax Return Taxjar

Tax Filing Deadline 2020 When Are My State Taxes Due Tax Refund Income Tax Deadline Filing Taxes

How To File A California Sales Tax Return Taxjar

Cpa Exam Cpa Exam Accounting Exam Cpa

New 2020 Ctec Requirements Start July 1 Federal Income Tax Income Tax Return Tax Preparation